Public Service Loan Forgiveness (PSLF) Buyback

Learn more about this opportunity for borrowers to earn loan forgiveness.

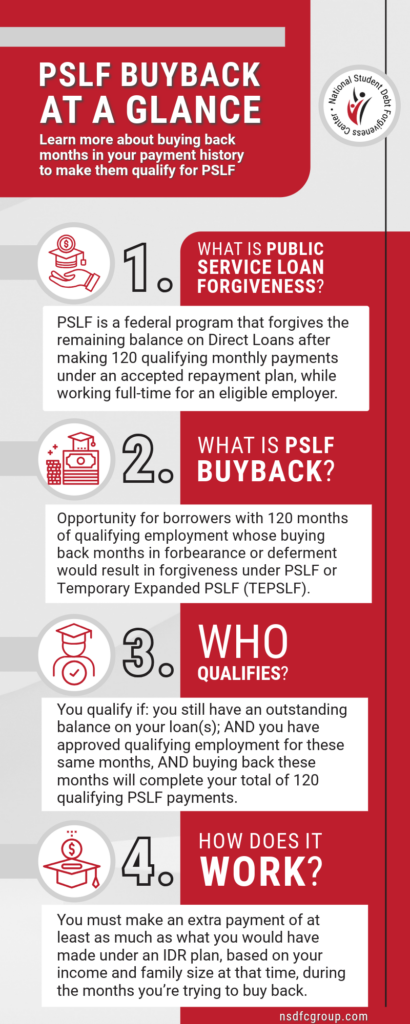

At a glance: The buyback opportunity is only available to borrowers who already have 120 months of qualifying employment and whose buying back months in forbearance or deferment would result in forgiveness under PSLF or Temporary Expanded PSLF (TEPSLF).

What is the PSLF Buyback?

Borrowers can now buy back certain months in their payment histories to make them qualifying payments for PSLF. Specifically, they can buy back months that don’t count as qualifying payments because they were in an ineligible deferment or forbearance status.

Three requirements to buying back PSLF:

- You can buy back these months only if you still have an outstanding balance on your loan(s); and

- you have approved qualifying employment for these same months; and

- buying back these months will complete your total of 120 qualifying PSLF payments.

How to Buy Back Months for PSLF

You must make an extra payment of at least as much as what you would have made under an income-driven repayment (IDR) plan during the months you’re trying to buy back. The amount required will be based on your income and family size at the time of the deferment or forbearance, not your current income and family size.

What the Department of Education (ED) is saying

Before submitting a PSLF buyback request, we strongly encourage you to wait until accounts are updated through the payment count adjustment. If you’ve already submitted a PSLF form and have approved qualifying employment, you may see updates in fall 2024. This includes PSLF credit for months of eligible deferment or forbearance at no added cost to you.

ED requires 120 months of approved qualifying employment to ensure that buying months of deferment or forbearance results in you achieving forgiveness. This prevents borrowers from unnecessarily buying back months that are not eligible for PSLF credit.

PSLF buyback is available for months on Direct Loans with a positive balance that coincide with qualifying employment when you were:

- in deferment,

- in forbearance, or

- in deferment or forbearance after the first disbursement date of a Direct Consolidation Loan.

You can’t buy back months during which your loan was in any of the following statuses:

- In-school or In-origination

- In-grace

- Default

- Bankruptcy

- Total and permanent disability monitoring

You can’t buy back any months on loans that are:

- not a Direct loan,

- in a paid-in-full status,

- in a forgiven status,

- in a discharged status, or

- included in a Direct Consolidation Loan.

The buyback amount depends on what your payment amount likely would have been during the deferment or forbearance for the months you’re buying back.

If you were on an IDR plan immediately before or after the months you’re buying back:

If the deferment or forbearance was less than a year in length, ED will use the lower of the two monthly IDR payments for the months before or after the time in deferment or forbearance.

If you were not in an IDR plan before or after the months you’re buying back:

- ED will request tax information for that calendar year to determine the amount that you would have paid under an IDR plan. If your deferments or forbearances cross over multiple tax years, they will need your tax information for each year.

- If you were not required to file a tax return for the period of time you are requesting to buy back, ED will need you to submit a statement to that effect.

- In addition to the tax information requested above, you would need to provide a statement informing ED of what your family size was for that same period of time.

- Your payment amount will be based on the lowest IDR amount you were eligible for at the time of the deferment or forbearance. If the 10-year standard payment is lower than your calculated IDR payment, then the 10-year Standard payment amount will be used.

- If you don’t send ED the tax and family size information that as requested within 30 days, ED will determine your buyback amount as what your payment amount would be on the 10-year Standard Plan.

If ED calculates your buyback agreement to be $0, they will proceed with processing forgiveness on your loan when they send you the buyback agreement as no payment will be required.

Eligibility

You can buy back months of deferment or forbearance only if you have all the following:

- A Direct Loan with an outstanding positive balance or the outstanding interest balance is greater than zero.

- At least 120 months of certified qualifying employment and no plans to certify any additional qualifying employment.

- Certified qualifying employment that includes the months of deferment or forbearance you intend to buy back.

If you’ve consolidated your loans, you can buy back months only on the current consolidation loan. You can’t buy back months from the loans included in the consolidation loan or for any period prior to the first disbursement date of a consolidation loan.

Who is NOT Eligible

You are not eligible for PSLF buyback if any of the following are true:

- You do not have at least 120 months of qualifying employment already certified.

- You do not have enough months to buy back to reach forgiveness under PSLF or Temporary Expanded PSLF (TEPSLF).

- You only have outstanding Federal Family Education Loan (FFEL) Program loans, outstanding Perkins Loans, or other outstanding non-Direct Loans*

- All your loans are paid-in-full, forgiven, discharged, or included in a consolidation loan.

*You can consolidate these loans into a Direct Consolidation Loan to be eligible for PSLF, but you will not be eligible to request a buyback for months on the loans that are included in the Direct Consolidation Loan.

After Submitting a Request

You’ll get an automated email from ED confirming that they’ve received your reconsideration request. As many people are expected to request buyback, and each account review will need in-depth analysis, you won’t be able to check the status of your request after submission. ED only promises to respond to the request by email as soon as possible.

Yes, you must continue to make student loan payments until review is complete and buyback is approved.

ED will email you a PSLF Buyback Agreement in response to your request. This agreement will detail the total buyback amount you must pay and instructions on how to do so. Your servicer must receive the total buyback amount within 90 days of the date of the letter.

If the full amount is not received within 90 days of the date the agreement was sent to you, the agreement will be void and you will be required to start the process over. The agreement will also be voided if any of the following happens:

- You submit a PSLF form after ED has sent you the agreement.

- Your loan is paid off after ED has sent you the agreement.

- You apply for or consolidate your loan after ED has sent you the agreement.

- Your loan is discharged or forgiven for any reason after ED has sent you the agreement.

You must continue to make your regular monthly payment if a payment is due. You will receive a refund if your payment exceeds the amount identified in the PSLF Buyback Agreement and you have no additional outstanding loans. Payments that exceed your PSLF Buyback Agreement will be first applied to other outstanding loans before any refunds are issued. If your PSLF Buyback Agreement is voided, the payments you made to buyback will be credited as regular monthly payments, and they will not be refunded to you.

No. The PSLF buyback program is managed by the U.S. Department of Education (ED), not your loan servicer.

Yes, you are still responsible for your current student loan payment until the forgiveness is applied. The total amount of your buyback must be paid to your servicer within 90 days of when ED sent you the buyback agreement or the agreement will be void. If you make payments that exceed the amount identified in the PSLF Buyback Agreement, you will receive a refund only if you have no additional outstanding loans.

Yes, you can make multiple payments to your servicer, but the full amount must be paid to your servicer within 90 days of when ED sent you the buyback agreement.

PSLF Buyback FAQs

Answers to your most frequently asked questions. Information provided by the U.S. Department of Education (ED).

You will receive a communication from us if you are not eligible for PSLF buyback. You should continue to make loan payments and certify employment.

If you are unable to pay the amount in your buyback agreement within 90 days, the agreement is void. You’re still responsible for the amount due in your monthly billing statements. If you later reapply for a buyback agreement, you might need to resubmit requested documentation.

In many circumstances, the payment account adjustment will automatically credit periods of forbearance and deferment without you making a payment to buyback that month. Additionally, ED is working on implementing new regulations in 2024 that credit borrowers for months previously spent in specific deferments.

If you have not consolidated your Direct Loans, you can buy back months starting with Oct. 2007, when the PSLF program was established by law.

If you have Direct consolidation loans, you can buy back starting with whichever is most recent: Oct. 2007 or the earliest disbursement date of your Direct Consolidation Loan.

Since you are only able to buy back enough months for forgiveness under PSLF or TEPSLF, you can’t buy back earlier months to reverse payments made on more recent months for a refund. Separately, you can’t receive a refund unless your payment exceeds the amount identified in the PSLF Buyback Agreement and you have no other additional outstanding loans.

According to the Internal Revenue Service (IRS), student loan amounts forgiven under PSLF or TEPSLF aren’t considered income for federal tax purposes. For more information, check with a tax advisor.

As long as you were employed in the same month associated with your 120th payment and your loan still has a positive balance, then you will be eligible to participate in buyback and receive forgiveness.

If you have an outstanding parent PLUS loan, ED will use the 10-year Standard Repayment Plan to calculate your equivalent payment amount. For borrowers with a Parent PLUS loan included in a Direct Consolidation Loan, ED will use the Income Contingent Repayment (ICR) Plan calculation.

Parent PLUS loans are not eligible for TEPSLF.

No. Because you are only able to buy back enough months for forgiveness under PSLF or TEPSLF, you cannot buy back months on a loan and then consolidate to have the months that are bought back applied to the consolidation loan.

The IDR buyback program will not be available before the summer of 2024. The program will be similar to the PSLF buyback program but will have different rules for which months can be bought back. We will update this page when more information is available.

Yes. ED initially used the term “hold harmless” in the Notice of Proposed Rulemaking and the initial rounds of negotiated rulemaking. The term “buyback” refers to the way they are enacting the final rule.

Any month that is a qualifying PSLF payment is also a qualifying TEPSLF payment. For the purposes of buyback, you can only buy back periods using PSLF, but ED will calculate an equivalent payment using an IDR payment amount that can also be applied to TEPSLF.